rhode island tax rates 2020

1 Rates support fiscal year 2020 for East Providence. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

2022 Property Taxes By State Report Propertyshark

About Toggle child menu.

. The average effective property tax rate in Rhode Island is the 10th-highest in the country though. 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. If you live in Rhode Island and are thinking about estate planning this.

State of Rhode Island Division of Municipal Finance Department of Revenue. 2020 Rhode Island Property Tax Rates on a Map - Compare Best and Worst RI Property Taxes Easily. Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Rhode Island Tax Brackets for Tax Year 2022. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of.

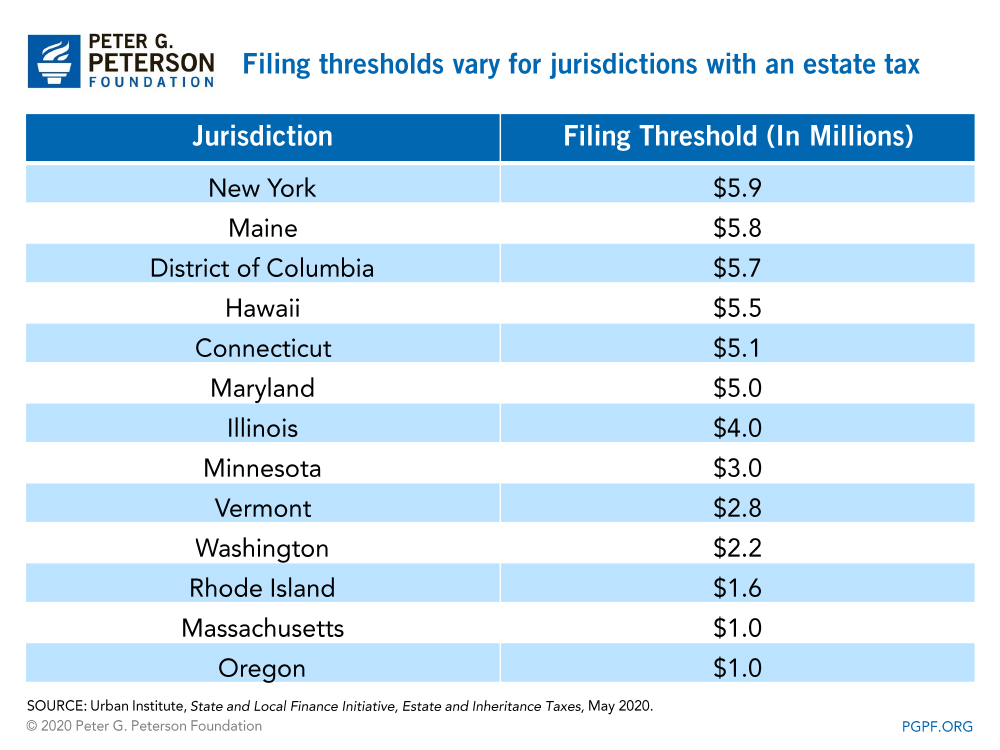

3 West Greenwich - Vacant land taxed at. Rhode Island Tax Brackets Rates explained. It kicks in for estates worth more than 1648611.

Compare your take home after tax and estimate. TAX DAY IS APRIL. 1463 for Real Estate and Tangible Property.

The top rate for the Rhode Island estate tax is 16. Detailed Rhode Island state income tax rates and brackets are available on this page. Find your income exemptions.

Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009Rhode Islands tax brackets are indexed for. 41 rows Rhode Island Property Tax Rates. Exemptions to the Rhode Island sales tax will vary by state.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Current and past tax year RI Tax Brackets Rates and Income Ranges. Above rates do not include Job Development Assessment of 21 or 008 adjustment for 2020.

Find your pretax deductions including 401K flexible account. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. Recent Tax Rate History - Tax Rates from 1893 - 1996.

Rhode Island new employer rate. Rhode Island Income Tax Rate 2022 - 2023. Start filing your tax return now.

2 Municipality had a revaluation or statistical update effective 123119. Both the state income and sales taxes are near national averages. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in.

2020 Rhode Island Property Tax Rates Hover or touch the map below for more tax rate.

Ripec Bryant University S Center For Global And Regional Economic Studies Release New Key Performance Indicators Quarterly Briefing Rhode Island Public Expenditure Council

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Map Of Rhode Island Property Tax Rates For All Towns

Rhode Island Income Tax Calculator Smartasset

Amazon Has Record Breaking Profits In 2020 Avoids 2 3 Billion In Federal Income Taxes Itep

Rhode Island Income Tax Ri State Tax Calculator Community Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Are Estate And Gift Taxes And How Do They Work

Monday Map Top State Income Tax Rates Tax Foundation

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Sales Tax On Grocery Items Taxjar

Rhode Island Employee Retention Credit Erc For 2020 2021 And 2022 In Ri Disasterloanadvisors Com

Rhode Island Sales Tax Quick Reference Guide Avalara

Map Of Rhode Island Property Tax Rates For All Towns

Rhode Island Income Tax Calculator Smartasset

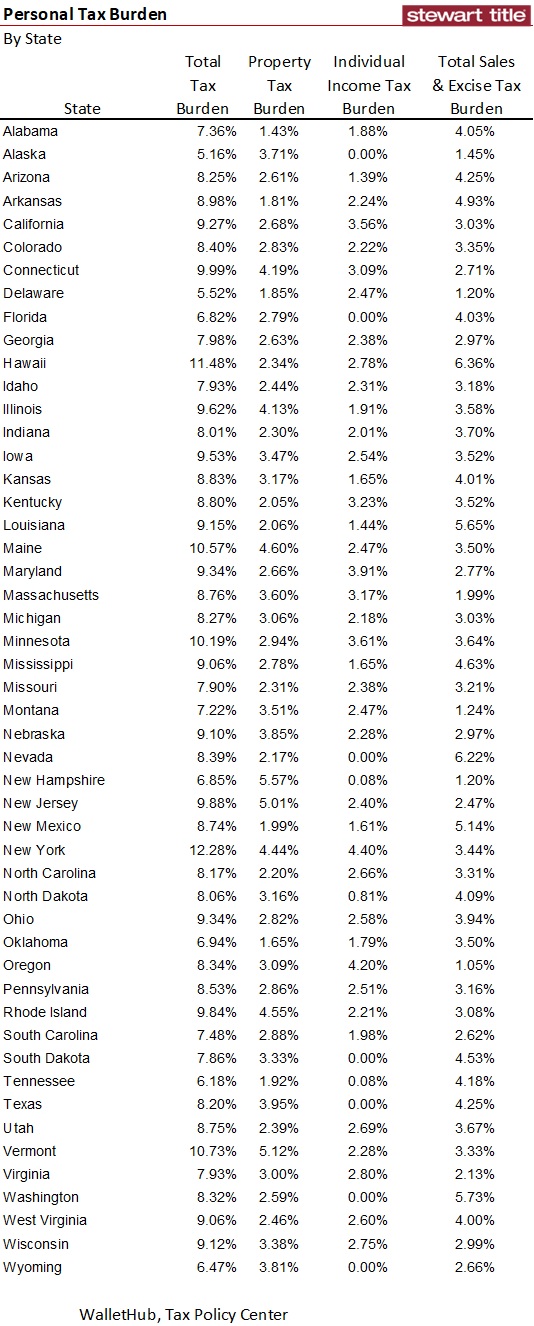

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep